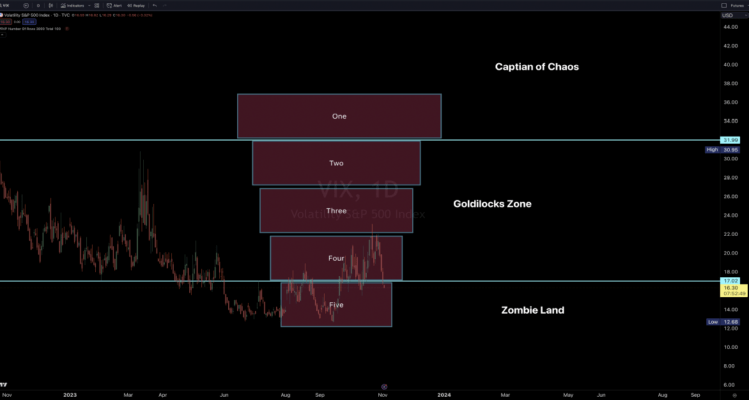

The chart effectively communicates how you adjust the width of your Butterfly spreads and overall risk in response to varying volatility regimes in the VIX. Different volatility environments (Chaos, Goldilocks, Zombie Land) necessitate different strategic adjustments to optimize trading performance and manage risk efficiently.

- Chaos (Captain of Chaos): When the VIX is roaring, and the market feels like a rollercoaster on steroids, we’re squarely in the realm of Chaos. It’s tumultuous, but it’s also ripe with opportunities. Here, the strategy leans towards wider Butterfly spreads, adapting to the increased volatility. The boxes from ‘One’ to ‘Five’ illustrate a progressive widening of spread widths, symbolizing an expansion of risk and potential reward in the tumultuous environment.

- Goldilocks Zone: Neither too hot nor too cold. This is where the market feels just right. Volatility is present but doesn’t throw the market into a frenzy. Here, our strategy finds a balanced footing, exercising a medium width in Butterfly spreads, ensuring that we are positioned to capitalize on market movements without overexposing ourselves to risk.

- Zombie Land: In the eerie calm where the VIX is low and the market lethargically moves, welcome to Zombie Land. Here, the strategy is tuned towards narrower Butterfly spreads. With lower volatility, the approach is more conservative, leaning towards precision and protection of capital.

The Sweet Spot: Embracing Variability

Nobody has a crystal ball in trading. We’re not fortune-tellers; we’re strategic navigators. Seeking the ‘sweet spot’ in trade setups is an ongoing quest. Since perfection is elusive, embracing a range of values in Butterfly widths and risk-torewards is essential. It’s like casting a net, ensuring a diversified approach that can resonate with different market vibrations.

Analyze, Correlate, Adapt

Regular analysis and correlation with market structures, volatility, and price action are crucial. It’s not about setting a strategy on autopilot; it’s about continuous evolution and adaptation. By analyzing performance, correlating it with market variables, and adapting based on insights, we ensure that the strategy remains dynamic and resonant with market rhythms.

Conclusion: Navigating the Volatility Seas

Our trading philosophy is akin to navigating the vast seas of volatility. Different weather (volatility regimes) require different navigational strategies (Butterfly widths and risk-to-rewards). The goal is not to conquer but to adeptly navigate, ensuring that our trading ship withstands the market’s storms and finds prosperous routes to success.

Remember, in the world of trading, adaptability is our greatest ally, and continuous learning is our most potent weapon. Armed with this wisdom, let’s continue our journey on the seas of the market, navigating with strategy, precision, and a relentless spirit of exploration and improvement