- Position Sizing

- Trade entry strategies

- Profit management strategies

- Staging Trades

- Pattern Day Trader Hack

Position Sizing Strategy

Perhaps the most important aspect of trading is position sizing, because this is where all your risk management stems from. Your position size is a direct reflection of your capacity and tolerance for risk.

This is particularly important with 0-DTE because of the asymmetric nature of the strategies we employ. Your maximum position size will represent a small portion of your overall trading capital and will be sized based on the concept of always having enough capital to continue trading, even after the worst conceivable event occurred.

So, for example, imaging that you went on a losing streak for 1 month straight, losing every trade. Ask yourself how much could you lose after 25 straight losses where you could still say you were comfortable with continuing with the strategy?

Whatever that number is, divide it by the number of losses, say 25, then take each instance and divide that by 3 to 5. That number will be your minimum sized trade, the size you start each trade with. We call it a tranche, and you max position size is made up of 3 to 5 tranches, you decide.

Let’s assume you have a $25K account, and you could see losing 1/5, but no more, and still feel okay with trading. Now, let’s take that 1/5, or $5k and divide it by the number of trades in a month. We’ll use 20 as a standard. That comes out to $250. This is your maximum position size.

Tranches

Now let’s figure out how much one tranche equals. 250 divided by 5 is $50. So, one tranches, or the smallest sized trade you would put to work, is $50. You might decide to break that up into 3 possible positions. Start with 2 tranches, and if necessary, add 2 more, and then under certain circumstances you add the last, to make your max position size.

You can devise many different strategies with up to 5 tranches, so long as you always start with no more than 3/5 of the max position. This is purely an example, but a good guideline to follow. If you had a $10k account, then the numbers are going to change and you may have fewer tranches in a max position.

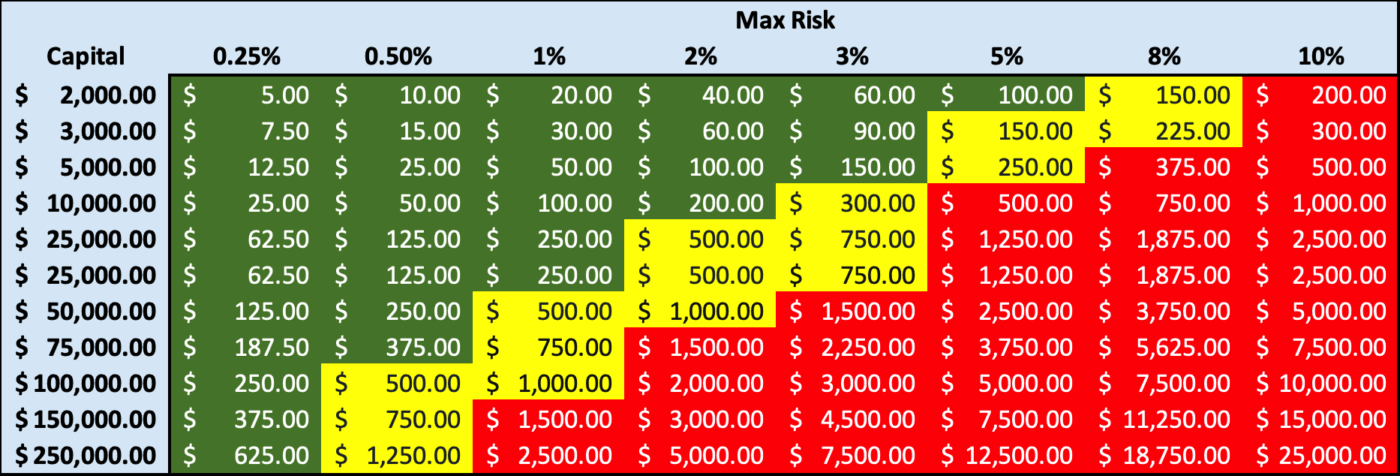

Position Size Based on % Capital

The following chart suggest a common way to select your ideal maximum position size.

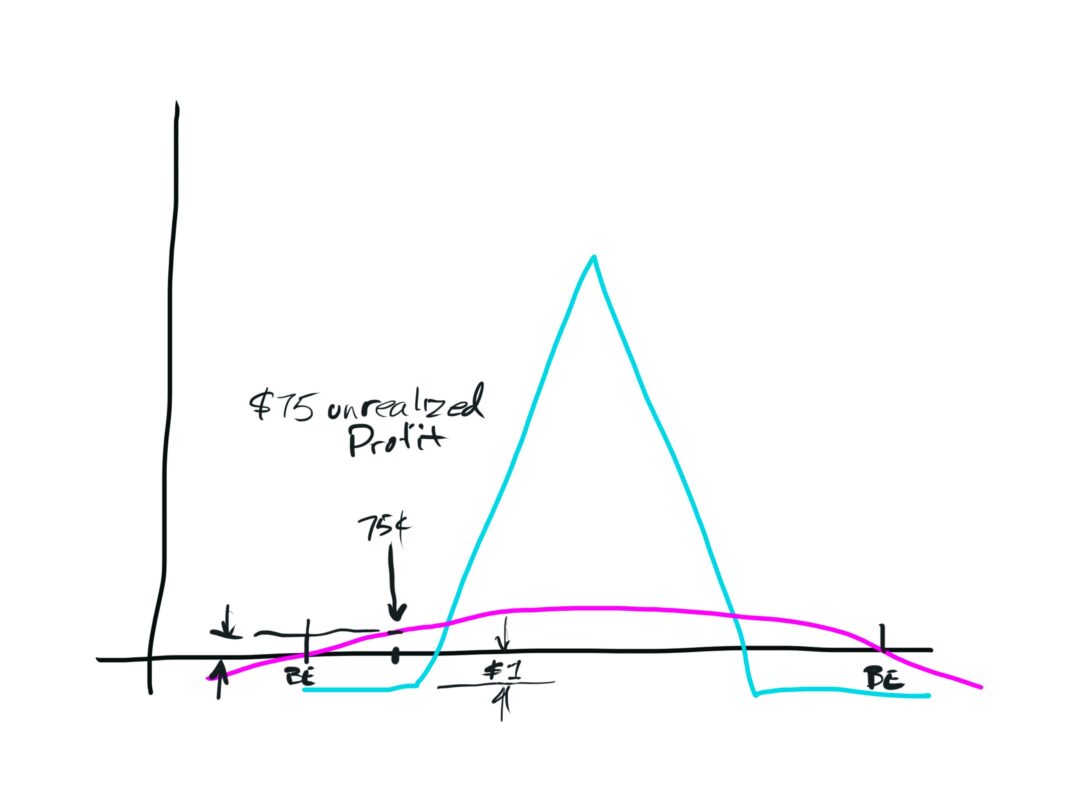

The first exit strategy occurs more often, and that is price is outside the profit tent, but close enough so that the strategy shows an unrealized gain. The image below shows a fly with $1 of risk with about 75 cents of profit. So, ignoring commissions and fees for now, that represents 75% profit on the capital at risk. And we want to figure out an objective way to preserve that profits.

There’s no doubt that 75% profit is an excellent return, and very few people would tell you it’s not a good idea to take profit. Except maybe in this situation, where you could potentially realize far more profit, maybe many times more. So the decision you make here can mean a lot to your bottom line, and the future decisions you make should at least try to maximize your return. So, the big question is, do you get out now, or do you wait for a potentially bigger return. The answer is a qualified …it depends. It depends on a lot of things, but you need a way to make a decision now…do you exit, or do you hold?

What you need is an objective way to make the decision, a way that will tell you it’s better hold or better to fold. This decision can be made by creating a decision framework