Introduction

Trading zero days to expiration (0DTE) strategies using options on the E-mini S&P futures can be lucrative to profit in the markets. However, traders must navigate several challenges and concerns to be successful.

This complete guide will cover the major topics and concerns related to 0DTE options trading using the E-mini S&P futures as the primary asset type. We will discuss strategies for reducing high commissions and fees, managing assignment risks, understanding price differences between the ES and SPX, taking advantage of trading off hours, the pattern day trader rule and its impact on SPX options, contract specifications, and rollover events, the spread between the /ES and the SPX, using the ES for analysis with volume profile, comparing the ES and SPX options, and the best ES options strategies for 0DTE trading. This article is intended for retail and professional day traders looking to make informed decisions about 0DTE options trading using the E-mini S&P futures.

- Reducing High Commissions and Fees in 0DTE Options Trading

- Managing Assignment Risks in 0DTE Options Trading

- Understanding Price Differences Between the ES and SPX in 0DTE Options Trading

- Maximizing Returns with 0DTE Options Trading Off Hours

- The Pattern Day Trader Rule and SPX Options in 0DTE Trading

- Contract Specifications and Rollover Events in 0DTE Options Trading

- Exploring the Bid-Ask Spread Between the /ES and the SPX in 0DTE Options Trading

- Using the ES for Analysis with Volume Profile in 0DTE Options Trading

- Comparing ES and SPX Options in 0DTE Trading

- The Best ES Options Strategies for 0DTE Trading

Reducing High Commissions and Fees in 0DTE Options Trading

One of the significant challenges of 0DTE options trading using the E-mini S&P futures is the high cost of commissions and fees. These costs can eat into profits and make achieving a positive return on investment difficult. However, there are ways to reduce the impact of commissions and fees on your trading.

One strategy is to choose a brokerage firm with a competitive commission and fee structures. Some brokers offer lower rates for high-volume traders or discounts for frequent trades. It’s also important to consider other fees, such as exchange and clearing fees, as well as any additional charges that may be applied to your trades.

Another way to reduce the impact of commissions and fees is to focus on trading strategies that minimize the number of trades you make. For example, consider using options spreads or other strategies that involve multiple legs instead of individual trades. These strategies can help you achieve your investment objectives while minimizing the cost of commissions and fees.

You can also choose strategies where the asymmetry between risk and the potential reward is significant enough that the range and potential of possible returns diminish the trade cost.

Managing Assignment Risks in 0DTE Options Trading

Another concern for traders using 0DTE options on the E-mini S&P futures is the assignment risk. When you hold a long call or put option, there is always the risk that the holder of the option will assign you an exercise notice after expiration if any of your position is in the money (ITM). You are obligated to buy or sell the underlying asset at the agreed-upon strike price.

This can be especially problematic in the case of 0DTE options because the assignment will happen after the cash market closes. If you can not cover the margin requirements, your broker will close the position for you and likely lock your account from further future trading. You will need to beg them for access to futures trading to be returned to you. Don’t expect them to return it if you do it a second time.

To manage assignment risks in 0DTE options trading, you can use strategies such as closing out your position before expiration or rolling your position to a different expiration date. You can also use tools such as covered call writing or protective puts to mitigate the assignment risk. It’s important to carefully consider the potential risks and rewards of any 0DTE options trade and choose strategies that align with your investment objectives and capacity and tolerance for risk.

Understanding Price Differences Between the ES and SPX in 0DTE Options Trading

Another important consideration in 0DTE options trading using the E-mini S&P futures is the price difference between the ES and the SPX. The ES and SPX are both based on the S&P 500 index, but they have some key differences that can affect the price of options. For example, ES options are based on the underlying ES futures contract, while the SPX is an options contract based on the spot price of the index. Additionally, the ES is traded on the Chicago Mercantile Exchange (CME), while the SPX is traded on the Chicago Board Options Exchange (CBOE), which can also affect pricing.

In the case of the S&P index, the spot price represents the current level of the index based on the prices of the individual stocks that make up the index. On the other hand, a futures contract is an agreement to buy or sell an asset at a predetermined price on a specific future date. The futures price of the S&P index represents the expected price of the index at the time the futures contract expires.

The spot price of the SPX reflects the current market price, while the futures price reflects the expected price at delivery, which happens when the futures contract expires. The E-mini futures contract has four expiration dates per year; December (ESZ), March (ESH), June (ESM), and September (ESU).

At the time of expiration, the price of the futures contract and the price of the Index are nearly identical. However, the new futures contract for the coming expiration is priced differently. And when the market rolls from the previous futures contract to the new contract, there is often a significant discrepancy in price. The forward, new, or front contract is usually priced higher than the index. This forward pricing situation is called contango.

This can confuse the options trader because they have two options contracts, one for the futures and one for the index, both based on the S&P market, yet there is a significant gap in the pricing. As the contract ages and approaches expiration, this price differential degrades until the time has come for the current or front contract to expire, where it again reaches price parity with the SPX price.

Maximizing Returns with 0DTE Options Trading Off Hours

One way to maximize returns in 0DTE options trading is to take advantage of trading off hours. The markets are open for a limited time each day, and trading activity tends to be highest during regular market hours. However, there are also opportunities to trade during off-hours, such as before or after the market closes.

Trading off hours can be riskier than trading during regular market hours because there is typically less liquidity and greater price volatility. However, there can also be opportunities to capture moves in the market that might not be possible during regular hours. Some specific opportunities to consider when trading 0DTE options during extended hours include the following:

- Economic reports: Economic reports can move markets and provide opportunities for traders to capture profits.

- Volatility as Asian and European markets open: As other markets open, there may be an increase in volatility that traders can take advantage of.

- Geo macro events: Major news events or geopolitical developments can affect market prices and provide opportunities for traders to profit.

- Federal Reserve governors: Comments or statements from Federal Reserve governors can affect market expectations for future rate hikes, providing potential trading opportunities.

- Earnings reports: Earnings reports from heavyweight companies can affect market prices and provide opportunities for traders to profit.

To maximize returns with 0DTE options trading off hours, it’s essential to monitor market conditions carefully and be prepared to act quickly if necessary. It is also necessary to understand the underlying assets and market factors that may affect their prices. In addition, traders should consider using strategies such as limit orders, stop-loss orders, and futures contracts to manage risk and take advantage of potential opportunities. Finally, traders should utilize tools and resources such as trading platforms with extended trading hours, market news and analysis, and real-time price quotes to stay informed and make informed trading decisions.

The Pattern Day Trader Rule and SPX Options in 0DTE Trading

The pattern day trader (PDT) rule is a regulation that applies to traders who make four or more day trades within a rolling five business day period. If you are classified as a PDT, you must maintain a minimum account balance of $25,000. If your account falls below this threshold, you can make further day trades once you meet the minimum balance requirement.

The PDT rule can be especially relevant for 0DTE options traders using the SPX, as the high volume and frequency of trades associated with 0DTE strategies can trigger the rule quickly. You understand the PDT rule and how it may impact your 0DTE options trading using the SPX. You may need to adjust your trading strategies or consider using alternative assets to avoid triggering the rule.

There are a couple of strategies for accounts smaller than $25,000 that you can employ to avoid being categorized as a pattern day trader and having your account restricted.

- Trade less and manage the number of trades you open and close in a five-day rolling widow. Most trading platforms will indicate the number of remaining transactions you have before you are in violation.

- Trade with the E-mini S&P futures contract, which is not subject to the PDT.

- Employ the Pattern Day Trader Hack. This is a strategy developed by our group. The basic strategy is that you open trades but never close them. You lock in profits by opening the opposite trade as the position with unrealized gain and then allow both to expire. This locks in the profit; your account will reflect that upon settlement.

Contract Specifications and Rollover Events in 0DTE Options Trading

When trading 0DTE events, you want to ensure that your risks are minimized and that you fully understand the assets you are trading. This means you should know everything about the specifications of the contracts and how they behave under all the circumstances you will encounter.

We trade options on the S&P futures and SPX because they are European-style options, meaning there is no assignment until after expiration. Therefore there is no risk of early assignment. This is important because an early assignment could ruin your day when you are near a pinned trade and your trade collapses because of an assignment event or a broker enforcing their margin rules.

If you take the position into expiration, you need to know that if any portion of your position is in the money, you will be assigned. With the SPX, this is no problem because the position is cash-settled; there is no underlying asset to be assigned to the SPX. The ES, however, has an underlying futures contract, so if you are in the money, you will be assigned a futures contract, which could impose market and margin risks. So either you should be prepared for this assignment possibility or leave the position before expiration. The latter choice is preferred.

Another contract fact that you must be aware of with the E-mini S&P futures is that rollover events can affect your trades. Rollover refers to closing a contract and opening a new one with a different expiration date. Rollover events can occur when the current contract nears expiration and a new contract with a later expiration date becomes available. Rollover events can affect the price of options and the profitability of trades, so it’s essential to understand how they work and how they may impact your business.

Of particular importance is that you know when the final day of the futures options contract expires. On that day, the expiration will be an AM or morning expiration, meaning the contract will expire at 9:30 AM eastern time. If you take a position before the cash market opening and are unaware of that early expiration, if any of your position is in the money (ITM), you might risk assignment by holding the contract into expiration.

Exploring the bid-ask Spread Between the /ES and the SPX in 0DTE Options Trading

The bid-ask spread is the difference between the bid price (the highest price a buyer might pay) and the asking price (the lowest price a seller might take). The bid-ask spread is also a measure of market liquidity and can significantly impact the price you pay for your options.

In the case of options for the e-mini S&P futures (ES options) and options for the SPX (SPX options), the differences in the bid-ask spread are relatively minor. The differences exist primarily due to volume in the respective markets, with a slight edge in the ability to fill a position going to the SPX.

Options for the E-mini S&P futures (ES) have approximately 1/4 the volume of the SPX. So, given that, one might expect the bid-ask spread to be wider and less liquid on the ES compared to options on the SPX. For most traders, those trading under ten contracts per position, this advantage is hardly noticeable, if at all. Most limit orders for ES and SPX are filled at the mid-price almost immediately (within 5-10 seconds). Of course, this largely depends on the volatility in the market.

This is true when trading multi-leg options like the butterfly or condor, where you must fill four contracts simultaneously. In my experience, you rarely have to change the price of your order to more than 10 to 20 cents, often only 5 cents, to get an immediate fill on a multi-leg position.

Some factors that might make it more challenging to get a fill are specifying a particularly wide spread or one that is very far out of the money. Also, selecting a broken wing fly that has strikes far out of the money, and in some cases, unbalanced flies, which have two additional contracts to fill over a regular butterfly that has a total of 4 contracts.

The most significant difference in the ability to fill an options position cannot be compared directly between the ES and SPX. And that is opening positions during non-market hours, which for most traders is only available for options on the ES. Most retail brokers do not offer extended hours trading for the SPX. However, even during the low volume, extended market, and Globex market hours, options for the E-mini S&P futures (ES) are relatively easy to fill, even multi-leg positions.

Using the ES for Analysis with Volume Profile in 0DTE Options Trading

Volume Profile is a technical analysis tool that helps traders understand a particular asset’s supply and demand dynamics. By analyzing the volume of trades at different price levels, traders can understand the buying and selling pressure in the market and make informed decisions about their trades.

The E-mini S&P futures (ES) can be helpful for volume profile analysis in 0DTE options trading. By analyzing the volume of trades at different price levels in the ES, traders can see objective evidence of where traders find more value and where it finds less value in the market. These changes in the volume reveal levels of inflection, where the market will discover natural support and resistance levels, as well as areas of high and low liquidity, which affects the behavior of price movements. Understanding how volume profile works and how it can be applied to the ES in 0DTE options trading is essential.

The SPX has no volume because it is a calculated index; it’s not traded, therefore, can have no volume. So, if you want to use the volume profile to analyze the SPX, you must use the E-mini S&P futures contract and its volume profile as a surrogate. This will provide a real-time tool that moves with a very high degree of correlation because they are derivatives of the same underlying market. The price may differ, depending upon what stage the futures contract is into its quarterly contract, but this is a simple adjustment and should provide no problem.

Comparing ES and SPX Options in 0DTE Trading

As mentioned, the ES and the SPX are both based on the S&P 500 index and can be used for 0DTE options trading. However, there are some critical differences between the two that traders should consider when making their trading decisions.

One significant difference is the underlying assets: the ES is a futures contract, while the SPX is an options contract. This can affect options pricing based on these underlying assets, margin requirements, and other factors. Additionally, the ES is traded on the CME, while the SPX is traded on the CBOE, which can also affect pricing and other aspects of trading.

The most significant difference between the options of the two assets is the size of the contract. The SPX is more than two times as large. Also, the multiplier is different. The SPX has a multiplier of 100, just like stocks; however, the E-mini S&P futures have a multiplier of 50. So, this is a difference that traders should be aware of to size their positions appropriately.

Another significant difference is with an assignment. You can be assigned a futures contract if your position is in the money at expiration with the E-mini S&P futures. This is a risk traders should be aware of, so they can manage. The SPX options are cash-settled. Therefore there’s no assignment risk.

There is one more significant difference: while technically, the ES futures and the SPX can be traded 23 hrs per day, very few retail brokers support around-the-clock trading for the SPX. Instead, they only support cash market hours. Both assets, however, expire at the same time, 4 PM eastern time each trading day.

To compare ES and SPX options in 0DTE trading, traders should carefully consider the pros and cons of each asset and choose the one that best aligns with their investment objectives and risk tolerance.

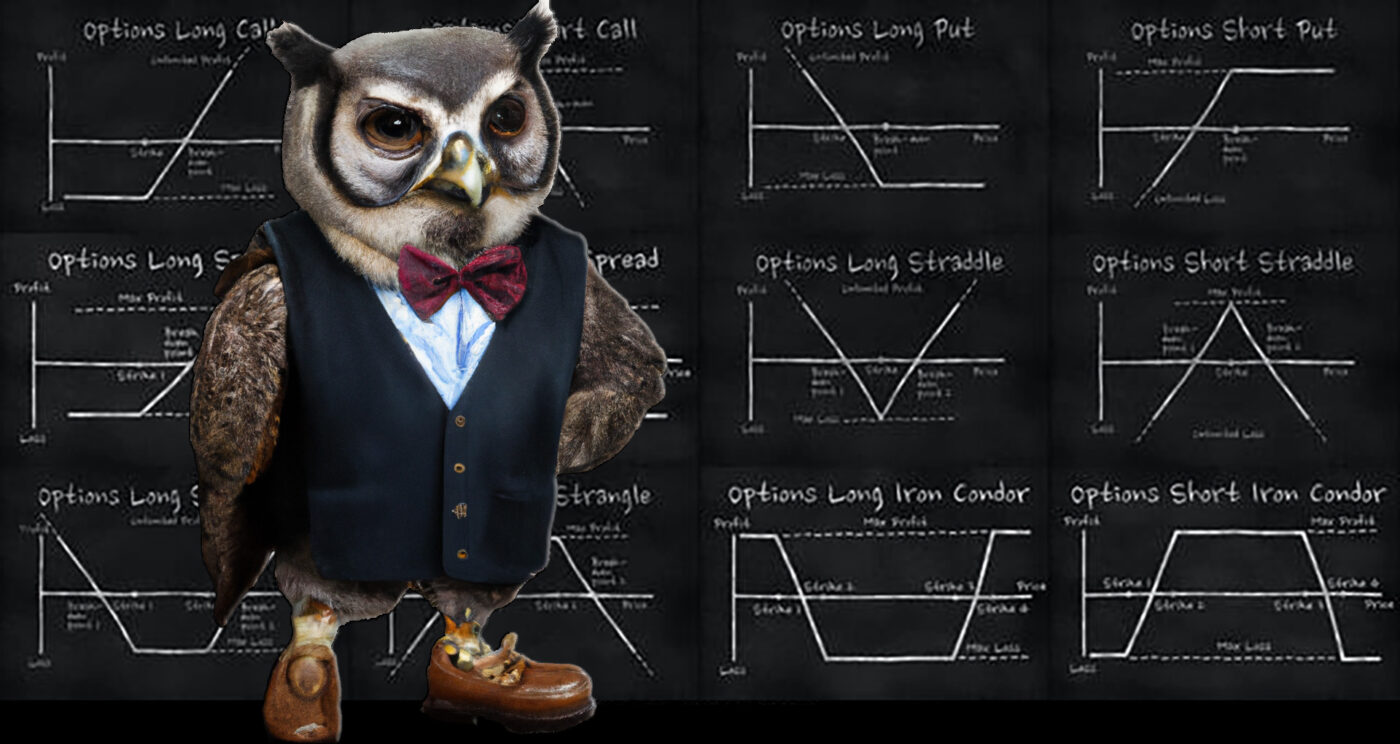

The Best ES Options Strategies for 0DTE Trading

Trading 0DTE options are about taking advantage of the exponential decay of premiums in those final hours of expiration. So, to maximize your returns, choose option strategies that are premium collectors and take advantage of quick changes in volatility. At the same time, you’ll want your position as asymmetric as possible with small defined risk, which means looking for strategies that are put out of the money.

In our experience, the two option strategies that meet these criteria are the butterfly and the condor. We like the calendar as well for its sensitivity to changes in volatility. However, it is a more niche choice. Let’s look at our favorite, the one we call the 0DTE classic, and examine its pros and cons during a 0DTE event.

The butterfly is a composite of the vertical spread, it can use all puts or calls, or you can use both puts and calls. Our preference is the more straightforward option using only one option type. The butterfly is remarkably flexible as a directional strategy; when used as a neutral strategy, where you place the strategy centered at the money, it loses much of its flexibility.

The primary advantage of placing the butterfly out of the money is the asymmetric risk-to-reward profile you can create. The further from the money you put it, the greater the asymmetry. Of course, the further you place also reduces your probability of profit and touch, so there are practical limits or sweet spots that we have found that work in varying market conditions.

The other primary way to control both its asymmetry and potential with the butterfly is to vary the width of the composed verticals. Our preferred orientation is to use equal-sized spreads, we call this a symmetric butterfly, and we notate it by referring to the width of one vertical. So, the butterfly was 25 wide and centered on SPX 3975, or using our shorthand; it would be 25W @ 3975.

As it is directional and placed above or below the market, our success rate depends on getting the right direction. Our most basic strategy for choosing a direction is to use a primary moving average, like the 50 EMA, and open a bullish position when above the average and a bearish position when below the average.

Strategy management is simple if the market goes in the wrong direction. You do nothing because you have a small defined risk; you accept that outcome. In some cases, the market will reverse, allowing you to manage profits, and in some cases, it won’t, and we often take a total loss. If the market goes in our direction, then we have a variety of profit management strategies based on market conditions and structure.

The condor is similar to the butterfly but does not afford the same degree of asymmetry. We use it when the implied volatility is at extremes. The calendar is also used in special conditions where volatility is anticipated to change abruptly.

We also have a market-neutral version of the butterfly. We place two Classic Flies on either side of the current market price, using similar asymmetry but with modified risk and profit management.