Mastering the Pattern Day Trading Rule for 0DTE Traders

Are you a savvy trader looking to navigate the Pattern Day Trading Rule while maximizing your 0DTE butterfly strategy’s potential? This guide delves into how zero-days-to-expiration (0DTE) traders can stay compliant with regulations, avoid common pitfalls and leverage unique trading techniques that align with their goals. Whether you’re a seasoned options trader or just starting out, understanding the nuances of the Pattern Day Trading Rule is crucial to your success.

Understanding the Pattern Day Trading Rule and 0DTE Implications

For 0DTE options traders, the Pattern Day Trading Rule (established by FINRA) can present unique challenges. This regulation applies when you execute four or more day trades within five business days, and it requires maintaining a minimum account balance of $25,000 in a margin account. You risk significant restrictions if classified as a pattern day trader without meeting the account balance requirement. For those trading 0DTE butterflies, this rule can feel particularly limiting due to the frequent adjustments and quick trade turnover that are often needed.

However, one strategic workaround involves transforming an active 0DTE butterfly position into a “box trade.” This technique involves shifting all shorts to longs, all longs to shorts, and converting puts into calls (or vice versa). Doing so creates a risk-neutral position that allows both trades to expire without triggering a pattern day trade count. Implementing such strategies can help you remain compliant while still capitalizing on short-term market opportunities.

Why a Solid 0DTE Trading Strategy Matters

When trading 0DTE butterflies, having a well-defined strategy isn’t just a best practice—it’s essential. The rapid time decay, the narrow profit windows, and the potential for sudden volatility mean that a structured approach is the foundation of success. A disciplined 0DTE trading strategy helps you:

• Determine Optimal Strikes: Use market conditions and volatility indicators to position your butterfly spreads for the highest risk-to-reward ratio.

• Adapt to Market Volatility: Adjust butterfly widths and positions as volatility shifts throughout the day.

• Lock in Profits Strategically: Employ techniques like the box trade to secure gains without violating day trading rules.

• Control Risk Tightly: Implement position sizing and conditional orders to protect your account from major losses.

Risk Management Techniques for 0DTE Butterfly Traders

Effective risk management is critical when trading 0DTE options. Given the fast-moving nature of same-day expirations, even small errors can lead to outsized losses. Key risk management tactics include:

• Using Conditional Orders: Set conditional orders to automatically execute a box trade when your butterfly reaches a certain profit target, preventing a manual close-out that could trigger a pattern day trade.

• Position Sizing Based on Volatility: Adjust the width of your butterfly spreads depending on the current implied volatility (IV). In high-IV environments, consider wider spreads for better reward potential; in low-IV environments, narrower spreads can help reduce risk.

• Daily Performance Reviews: Monitor how your 0DTE butterfly trades perform under different market conditions, refining your approach over time.

Psychological Resilience for 0DTE Trading

Trading 0DTE butterflies demands a clear, focused mindset. These trades’ short timeframe and precise nature mean that emotions can run high. To stay disciplined:

• Develop a Routine: Establish a consistent morning analysis process, reviewing the market structure, volatility conditions, and potential butterfly strike placements before making any trades.

• Embrace Continuous Improvement: View each trade as a learning opportunity, understanding that long-term success comes from gradual refinement of your strategy.

• Avoid Overtrading: With 0DTE trades, chasing every small movement is easy. Instead, stick to your trading plan and execute a few well-planned setups daily.

Tools and Resources for 0DTE Trading

Access to the right tools can make a world of difference. For 0DTE butterfly traders, these resources are invaluable:

• A Robust Trading Platform: Look for platforms that provide detailed options chains, advanced charting tools, and real-time data.

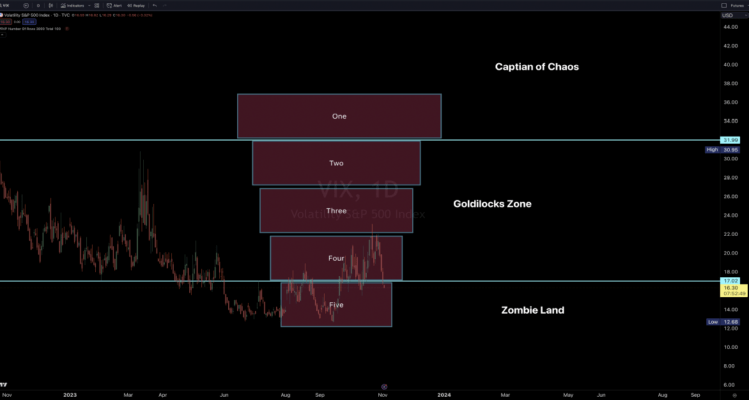

• Volatility Indicators: Regularly consult the VIX or similar indicators to gauge current IV levels and adjust your butterfly strategy accordingly.

• Educational Materials: Stay up-to-date with webinars, trading communities, and forums focused on 0DTE strategies. These can help you learn new techniques, improve your edge, and maintain consistency.

Avoiding Common Mistakes in 0DTE Trading

Even experienced 0DTE butterfly traders can fall into traps if they aren’t careful. Some of the most common errors include:

• Failing to Adjust to Volatility: Forgetting to modify butterfly widths as IV changes can lead to suboptimal risk-reward ratios.

• Ignoring Risk Management: Skipping steps like conditional orders or proper position sizing can quickly erode account equity.

• Neglecting Psychological Preparation: Overreacting to market fluctuations or holding losing positions too long undermines the discipline needed for consistent profits.

Conclusion: Excelling as a 0DTE Butterfly Trader

The Pattern Day Trading Rule doesn’t have to hold you back as a 0DTE butterfly trader. By understanding how to lock in profits through techniques like box trades, you can stay compliant while continuing to refine your approach. Build a solid foundation by focusing on strategic butterfly placements, disciplined risk management, and ongoing personal development. With the right mindset and a commitment to continuous improvement, you can thrive in the fast-paced world of 0DTE trading while minimizing risks and maximizing opportunities.