My Take: When it comes to the complexity and contentious nature of central banking policies and their real-world implications, the Federal Reserve operates on a dual mandate: to maximize employment and stabilize prices. In theory, these objectives should go hand in hand, contributing to a robust and sustainable economy.

Analysis: The relationship between employment, inflation, and monetary policy is multifaceted and not always linear. Traditional economic theories, like the Phillips Curve, suggest an inverse relationship between inflation and unemployment. However, real-world scenarios don’t always align with theoretical expectations.

- Government Spending and Debt Monetization: Expansionary fiscal policies, such as increased government spending and central banks’ subsequent monetization of debt, can fuel inflation. This influx of capital can boost demand, but when it outpaces supply, prices can soar.

- Employment and Inflation: The notion that strong employment markets cause inflation is a debated topic. While a thriving job market can increase disposable income and consumption, leading to higher demand and potentially higher prices, it’s not the sole driver of inflation.

- The Fed’s Approach: The Federal Reserve might tighten monetary policy (e.g., raising interest rates) to combat inflation, even if it comes at the cost of employment. The goal here is to cool down an overheated economy, which can lead to increased unemployment and market volatility.

The Dystopian Perspective:

- Questioning the Status Quo: It’s essential to evaluate and question the prevailing economic policies and approaches critically. Open discourse and a diversity of perspectives contribute to a more holistic understanding and better policy-making.

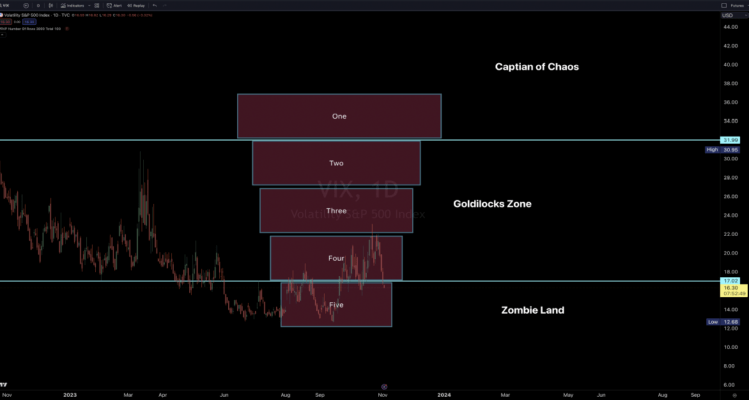

- Navigating the Landscape: As a trader and coach, understanding, adapting, and navigating these economic landscapes, even when they seem “dystopian,” is crucial. It allows you to make informed decisions, manage risks, and seek opportunities in the market’s reactions to these policies.

In this intricate dance of policies and market reactions, being informed, adaptable, and strategic is key. It’s about navigating the markets with insight, strategy, and a critical mind, ready to capitalize on opportunities that these economic dynamics present. Keep pushing forward, staying informed, and adapting to the ever-evolving economic narrative.

The FOMC SWAG

My Take: The Fed moves forward with their decisions as if they know the effect of them, but the reality is that they don’t know. They are almost always wrong in their long-term predictions on economic impact, inflation growth, and general market stability. It would seem everything they do is a SWAG (Scientific Wild Ass Guess), with the science part being the lesser part of that acronym.

Analysis: The Federal Reserve, with all its tools, models, and expertise, often sails in uncharted waters. Economic forecasting is not an exact science, and despite their thorough analysis and methodologies, predicting economic outcomes with absolute certainty is a tall order.

Here’s the breakdown:

- Uncertainty: The economic landscape is vast and influenced by a myriad of ever-changing variables. The list is endless for global events, technological advancements, political shifts, and consumer behavior. It creates an environment of inherent uncertainty.

- Policy Repercussions: Decisions made by the Fed, such as adjusting interest rates or asset purchasing programs, send ripples through the economy. However, the full impact of these decisions often unfolds over time and can be influenced by various unforeseen factors.

- Adaptability: Given the dynamic nature of the global economy, adaptability becomes key. The Fed, like traders, must be prepared to pivot their strategies based on evolving economic conditions and outcomes.

In the Trading Arena:

For traders, this uncertainty and the unpredictability of economic outcomes underscore the importance of flexibility, continuous learning, and risk management in trading strategies. The “SWAG” nature of economic decision-making implies that traders must be on their toes, ready to adapt to new information, policy shifts, and market reactions.

Your Strategy:

- Stay Informed: Keep abreast of the Fed’s decisions, economic indicators, and global events. Knowledge is your first line of defense and your most potent tool for making informed trading decisions.

- Risk Management: Given the unpredictability, ensure your trading strategy includes robust risk management protocols. Be prepared for volatility and ensure your positions are adequately hedged.

- Continuous Learning: The only constant is change. Continuous learning, adapting, and evolving trading strategies based on new information and changing economic landscapes are crucial.

So, while the economic forecasts and policy decisions might seem like a “SWAG” at times, your trading strategy doesn’t have to be. With knowledge, adaptability, and a solid risk management plan, you can navigate the markets with confidence and precision. Keep grinding, stay adaptable, and may the markets be in your favor!

IS THE FED A POLITICAL MONSTER?

My Take: The problem here seems political because the Federal Reserve NEVER takes or assumes responsibility for its actions, often placing blame on the consumer or other forces but always deflecting responsibility from themselves. They are one of the greatest influencers in the market, yet they NEVER acknowledge it.

Analysis: This is a poignant aspect of central banking – accountability and influence. The Federal Reserve wields significant power over the economic landscape, and their decisions ripple through markets, industries, and households.

Influence:

- The Fed’s policies undoubtedly play a massive role in shaping economic trajectories. Their interest rates and monetary policy decisions influence investment, consumption, and overall economic momentum.

Accountability:

- The notion of accountability is critical. The Fed operates with a mandate to promote maximum employment and price stability. However, the broader impacts of their policies, whether it be asset bubbles, inequality, or market dependencies, are not always fully acknowledged or taken responsibility for.

Political Dynamics:

- Central banks operate within complex political and economic environments. Their decisions, while economically motivated, are not made in a vacuum and can be influenced by, or have implications on, the political landscape.

For Traders:

- Understanding the political and economic dynamics that influence central bank decisions is crucial. It adds a layer of insight into market movements and potential shifts in monetary policies.

Strategy Moving Forward:

- Critical Evaluation: Always critically evaluate central bank statements and decisions. Look beyond the immediate policy implications and consider broader economic and political influences.

- Diversify: Given the uncertainties and influences in play, diversifying trading strategies can help manage risks associated with central bank decisions.

- Stay Informed: Keeping abreast of political developments, policy shifts, and broader economic trends is crucial. It provides a more comprehensive view of the market landscape.

The Fed’s influence is undeniable. For traders, it’s about navigating the markets with a nuanced understanding of these influences, making informed decisions, and managing risks effectively. It’s about playing the chessboard with a strategist’s mind, anticipating moves, and planning accordingly. Keep pushing forward with clarity, strategy, and unwavering focus